kentucky vehicle tax calculator

Key Takeaway No matter where you shop for a car in Kentucky your sales tax rate will be 6 of your total purchase price. For questions or to submit an incentive email the Technical Response ServiceFor additional incentives search the Database of State Incentives for Renewables Efficiency.

How To File The Inventory Tax Credit Department Of Revenue

Motor Vehicle Usage Tax is a tax on the privilege of using a motor vehicle upon the public highways of the Kentucky and shall be separate and distinct from all other taxes imposed by the Commonwealth.

. The non-refundable online renewal service fee is a percentage of the transaction total and is assessed to develop and maintain the Online Kentucky Vehicle Registration Renewal Portal. The median property tax on a 14590000 house is 153195 in the United States. Once you have the tax.

Kentucky Documentation Fees. Kentucky Department of Revenue. Of course you can also use this handy sales tax calculator to confirm your calculations.

Dealerships may also charge a documentation fee or doc fee which covers the costs incurred by the dealership preparing and filing the sales contract sales tax documents etc. Vehicle Tax Costs. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including. Search tax data by vehicle identification number for the year 2020. Close search bar.

Car loans in Kentucky 2022. Financial guarantee bonds like tax bonds Freight Broker Bonds and Health Club Bonds have proven. Property taxes in Kentucky follow a one-year cycle beginning on Jan.

The median property tax on a 14590000 house is 131310 in Jefferson County. Multiply the vehicle price before trade-ins but after incentives by the sales tax fee. The tax is collected by the county.

Kentucky Property Tax Rules. Email Send us a message. 1 of each year.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. The state tax rate for non-historic vehicles is 45 cents per 100 of value. How to Calculate Kentucky Sales Tax on a Car.

After a few seconds you will be provided with a full breakdown of the tax you are paying. For Kentucky it will always be at 6. Motor Vehicle Usage Tax.

Division of State Valuation. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county. Please allow 5-7 working days for online renewals to be processed.

Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

It is levied at six percent and shall be paid on every motor vehicle. Average DMV fees in Kentucky on a new-car purchase add up to 21 1 which includes the title registration and plate fees shown above. Since Kentucky sales tax is simply 6 of the total purchase price estimating your sales tax is simple.

Every year Kentucky taxpayers pay the price for driving a car in Kentucky. If you are unsure call any local car dealership and ask for the tax rate. Motor Vehicle Usage Tax Section PO Box 1303 Frankfort KY 40602-1303 6.

Motor Vehicle Property Tax. At the same time cities and counties may impose their own occupational taxes directly on wages bringing the total tax rates in some areas to up to 750. Kentucky has a flat income tax of 5.

Kentucky has a 6 statewide sales tax rate but also has 226 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top. Historic motor vehicles are subject to state taxation only. It is levied at 6 percent and shall be paid on every motor vehicle used in Kentucky.

For more information see page 2 of the Guide to Kentucky Inheritance and Estate Taxes. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts. Overview of Kentucky Taxes.

Vehicle tax or sales tax is based on the vehicles net purchase price. Compare your rate to the kentucky and us good news. Dealership employees are more in tune to tax rates than most government officials.

They are usually calculated using the assessed value of the property and the property tax rate of a certain region or municipality. Non-historic motor vehicles are subject to full state and local taxation in Kentucky. A 200 fee per vehicle will be added to cover mailing costs.

Processing Fees Payment Methods. Kentucky vehicle tax calculator. Every 2021 combined rates mentioned above are the.

View the Kentucky state and local ad valorem fee schedule to verify your exact amount and use the DMV Override to adjust the calculator. Vehicle Tax paid in 2020. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Kentucky Vehicle Property Tax Calculator. These fees are separate from. Are the NHU affidavits and documentation to be sent separately from the motor vehicle usage tax.

On average homeowners pay just a 083 effective property tax. DMV fees are about on a vehicle based on a 21 registration fee plus a 39 title fee plus a yearly property tax that varies by county. Vehicle licensing kentucky registration renewalVehicle registration fees insurance and other costs by state for 2021Vehicle tax paid in 2020Yearly registration fee is 2100.

Vehicle Tax paid in. January 14 2021 January 14 2021 January 14 2021. Hmm I think.

Payment shall be made to the motor vehicle owners County Clerk. Real estate in Kentucky is typically assessed through a mass appraisal. Its fairly simple to calculate provided you know your regions sales tax.

Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. That rate ranks slightly below the national average. Motor Vehicle Usage Tax refund claims are to be forwarded to.

Governmental units in Kentucky including county city school and special district levies. You can do this on your own or use an online tax calculatorYour vehicle license platedecal must be renewed each year. The median property tax on a 14590000 house is 105048 in Kentucky.

Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. When the out of state resident titles andor registers the property in this state the 6 Kentucky use tax. Depending on where you live you pay a percentage of the cars assessed value a price set by the state.

501 High Street Station 32.

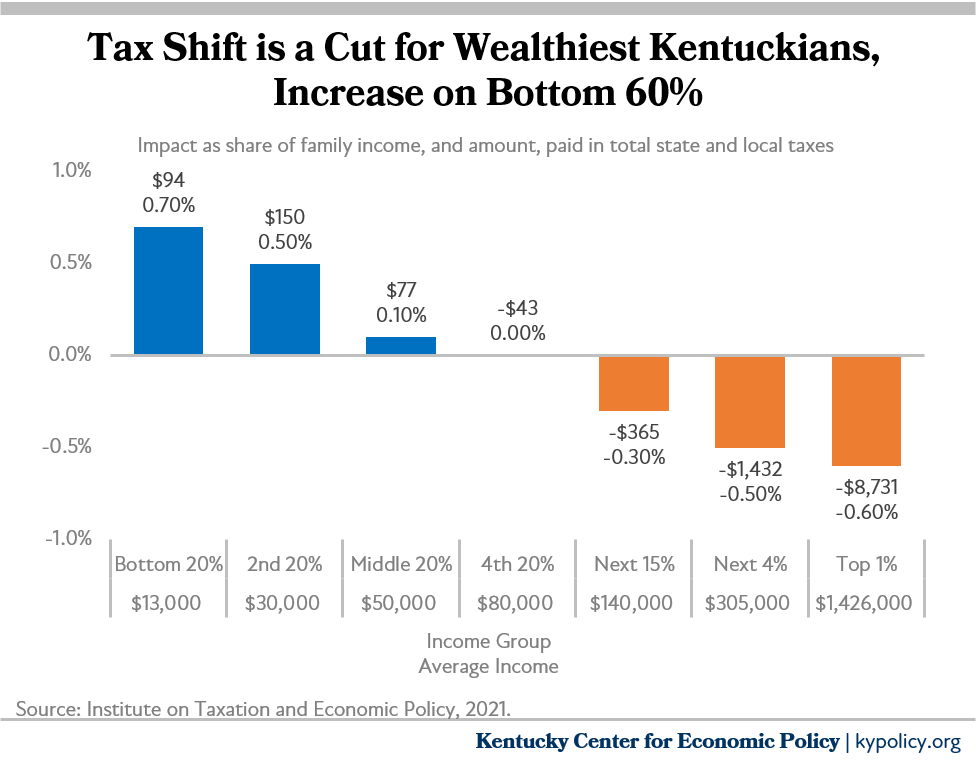

Further Shift Away From Income Taxes Would Worsen Inequities Harm State S Economy Kentucky Center For Economic Policy

Ky To Halt Rising Vehicle Property Taxes Governor Proposes Temporary Sales Tax Reduction Wchs

Pin On J Thomas Accounting Services

Taxes And Irs News Regulations And Scams Real Estate Agent Marketing Real Estate Agent Real Estate Tips

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Templates Party Invite Template Christmas Party Invitation Template

Sales Tax On Cars And Vehicles In Kentucky

Motor Vehicle Taxes Department Of Revenue

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Good Credit

Car Tax By State Usa Manual Car Sales Tax Calculator

Kentucky Releases Guidance On Inventory Tax Credit Bkd

Kentucky Used Car Prices Taxes Jump 40 Start 2022 Fox 56 News

2020 Vehicle Tax Information Jefferson County Clerk Bobbie Holsclaw

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

Kentucky Sales Tax Guide And Calculator 2022 Taxjar

Contractor Payroll Salary Packaging Novated Leasing Contractor Payroll Services Http Kentucky Nef2 Com Contracto Payroll Managing Your Money Contractors

Alcohol Taxes Department Of Revenue